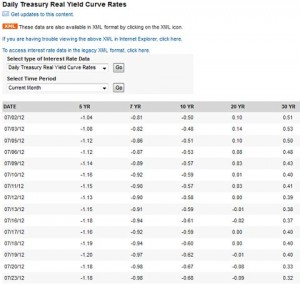

That’s from Professor Krugman’s blog post today entitled Free Money. It shows the interest rate the U.S. government pays on bonds that are indexed to inflation.

See those minus signs? Those indicate that investors are willing to pay the US government to borrow money from them. It’s not until you get to a 20-year bond that investors expect to get a return on their investment. That’s unheard-of.

As Krugman and many others have been saying for as long as this pattern has been exhibited, it would be a great time to “borrow” money to invest in infrastructure, thereby getting roads and bridges and airports and seaports and other public goods built or repaired and putting a lot of construction workers (and all the other workers whose jobs are on the periphery of construction: it’s not just dozer-drivers, it’s the men and women who do the bookkeeping for those heavy equipment operators’ employers, and the restaurants’ servers and cooks who feed those employees, and so on) back to work.

But no, the Professor says: “the Very Serious People have decided that the big problem is that Washington is borrowing too much, and that addressing this problem is the key to … something.”